Flipping a House? Key Renovations to Maximize Profit

- FreshLook

- Jul 31, 2025

- 7 min read

Thinking about flipping a house? You’re not alone — thousands of investors see house flipping as a powerful way to generate profit and build wealth. But the reality is: flipping can be risky if you don’t know what to look for, how to budget wisely, and where to focus your renovation dollars for maximum return.

In this guide, we’ll break down how to flip a house for maximum profit — from smart buying strategies and renovation tips to staging and selling for top dollar.

Why House Flipping Can Be So Profitable — and Risky

When you flip a house, you’re buying a property, fixing it up, and selling it for more than you put in — ideally, a lot more. The profit comes from your ability to spot undervalued homes, add real value through smart renovations, and sell quickly to minimize carrying costs.

But many beginner flippers lose money by overpaying, underestimating renovation costs, or picking the wrong neighborhood. That’s why the best investors know: the money is made when you buy, not just when you sell.

Before You Buy: How to Set Yourself Up for a Successful Flip

1. Research the Property’s Profit Potential

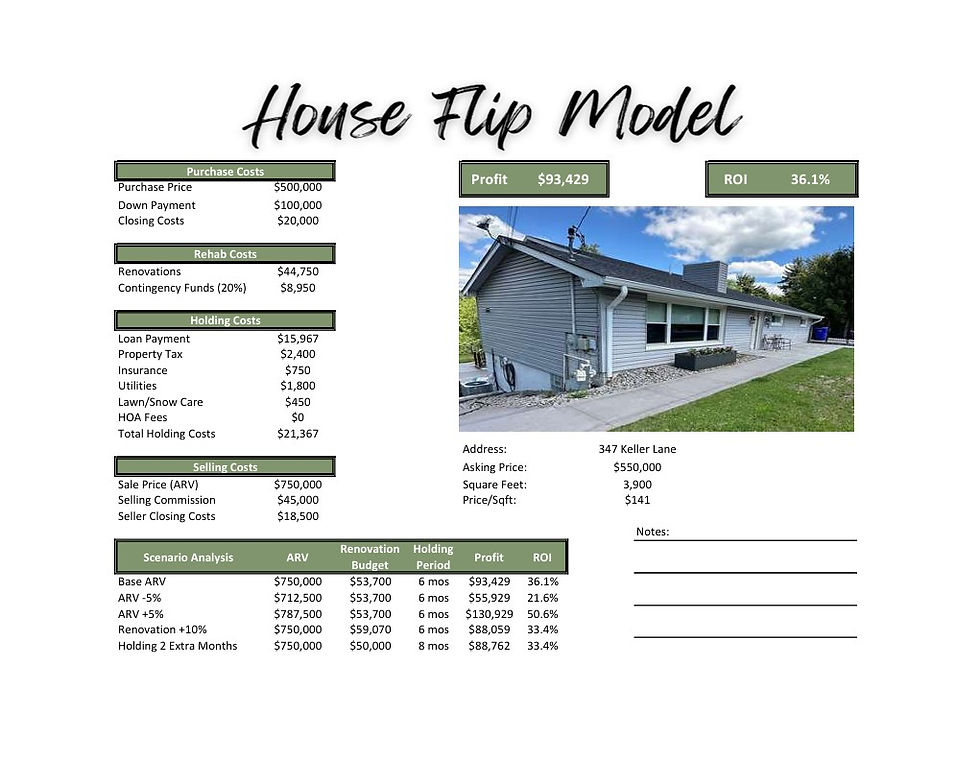

Before making an offer on any property, calculate these three numbers:

After-Repair Value (ARV): What will the house be worth once all the renovations are done? Use local comps within a half-mile radius and no more than 3–6 months old.

Renovation Costs: Get realistic estimates from contractors — and don’t forget permits, materials, labor, and a buffer for surprises.

Holding Costs: Fees you need to pay for as long as you own the property. They typically include:

Mortgage payments or loan interest: If you financed your flip with a loan or hard money lender, you’ll have monthly interest payments until the property sells.

Property taxes: Taxes don’t stop while you own the property — factor in the monthly cost.

Homeowners insurance: You need insurance to protect your investment during renovation, especially if you have a lender. Vacant home insurance may cost more than typical homeowner’s coverage.

Utilities: Water, electricity, gas — even if no one is living there, you’ll need these on for contractors to work.

HOA fees (if applicable): Some townhomes or subdivisions have mandatory fees.

Yard maintenance & basic upkeep: Even a vacant property needs the lawn mowed or snow removed to avoid city fines and maintain curb appeal.

Other expenses: Some investors budget for pest control, security, or property management if they’re flipping remotely.

If the numbers don’t work on paper, they won’t work in real life. Be conservative with estimates and always plan for unexpected costs.

2. Use the 70% Rule

Professional flippers often follow the 70% rule: Maximum Purchase Price = (ARV x 70%) – Repair Costs

For example, if the ARV is $300,000 and repairs are $50,000:($300,000 x 70%) – $50,000 = $160,000 max purchase price.

This ensures you have enough margin to cover costs and still make a profit.

3. Choose the Right Location for House Flipping

Location matters more than you think! Even the best renovation won’t save you if you flip in an area with low demand.

Here are some standout areas north of Pittsburgh to target for your next flip:

Ross Township: A solid choice for budget-friendly flips with strong buyer demand. Older brick ranches and split-levels are common — perfect for fresh kitchens, open floor plans, and updated baths.

West View: An affordable borough just minutes from downtown. Compact, charming homes appeal to first-time buyers wanting easy access to the city without city taxes.

McCandless Township: North Allegheny School District makes McCandless a top choice for families. Flippers often modernize 1960s–1980s homes with new kitchens, finished basements, and curb appeal improvements.

Shaler Township: Just north of the city, with stable resale values and classic mid-century houses. Focus on cosmetic updates and fresh landscaping to draw family buyers.

Hampton Township: Popular for bigger lots, good schools, and a suburban feel. Many homes here are spacious but dated — the right updates can command a premium price.

Wexford: An affluent area with newer subdivisions mixed with older properties that need modernizing. Wexford is prized for top-ranked schools and a high-demand housing market. Be prepared for higher acquisition costs, but your ARV can justify it.

Sewickley: One of Pittsburgh’s most desirable northern towns. Sewickley’s historic homes, walkable village, and excellent schools attract professional families. Restoring classic homes with modern finishes can yield impressive profits — but keep an eye on renovation costs for older structures.

Gibsonia: Offers a mix of rural charm and suburban convenience. Buyers love big yards and good schools (Pine-Richland School District). Many homes from the 70s–90s need updated kitchens, baths, and curb appeal.

Zelienople: A bit farther out but increasingly popular due to its small-town vibe and easy access to I-79. Buyers here want move-in-ready homes with modern updates but appreciate homes that keep some historic charm.

Cranberry Township: A booming northern hotspot for young families and commuters. Older homes near the core of Cranberry can be great flip candidates, especially if you focus on modern finishes buyers expect.

Bellevue: Closer in, this older borough offers charming fixer-uppers and a walkable main street vibe that appeals to younger buyers wanting character close to the city.

Pro Tip: In Pittsburgh’s northern suburbs, your biggest buyer pool is families looking for: Great schools, safe neighborhoods, modern kitchens and bathrooms, curb appeal and functional spaces.

When you run your numbers, check:

Local school district ratings (many buyers pick their home by the district first!)

Days on market for comparable flips

Average sale prices for renovated vs. unrenovated homes

Local development trends that could boost future demand

The suburbs of Pittsburgh combine affordability, steady demand, and good upside potential — making them a smart focus for profitable flips.

4. Find Undervalued Properties Off the MLS

The best deals often don’t show up on Zillow or Redfin. To find hidden gems:

Network with local wholesalers and real estate agents who work with investors.

Look for distressed properties: Foreclosures, short sales, or inherited homes.

Attend foreclosure or tax lien auctions.

Send direct mail to absentee owners or homeowners in pre-foreclosure.

Drive for dollars: Explore neighborhoods and look for vacant or run-down properties.

Social Media: Join a group specific to your search.

5. Understand the Market & Economy

Interest rates, buyer demand, and housing supply all affect your profits. When rates rise, buyers often hold back — meaning your flip could sit on the market longer. Pay close attention to local and national trends to time your flip right.

6. Learn to Negotiate Like a Pro

Securing the best deal starts with negotiation.

Understand the seller’s motivation: Are they relocating fast? Facing foreclosure?

Be respectful but firm: Don’t be afraid to walk away if the numbers don’t add up.

Build rapport: Sellers are more likely to work with buyers they trust.

7. Avoid Properties with Major Structural Issues

Cosmetic upgrades offer the best ROI — new paint, flooring, fixtures, and updated kitchens and baths. Major structural repairs (foundation, roof replacement, full electrical rewiring) can drain your budget fast.

During the Renovation: How to Add Maximum Value Without Blowing Your Budget

1. Focus on High-ROI Renovations

Some upgrades boost value far more than others.

Kitchen remodel: Often the top ROI — think new cabinets, counters, and modern appliances.

Bathroom upgrades: New tile, vanities, and fixtures freshen up the space.

Curb appeal: First impressions matter — fresh landscaping, a new front door, and a clean exterior paint job pay off.

Neutral colors: Stick to light, neutral palettes that appeal to the widest buyer pool.

2. Build a Smart Renovation Plan

A detailed plan prevents costly delays:

Get multiple contractor bids for fair pricing.

Outline clear timelines and milestones.

Check in regularly to monitor progress and address issues fast.

3. Hire the Right Contractors

Get referrals from other investors.

Read online reviews and check licensing and insurance.

Interview at least three contractors and request detailed quotes.

4. Negotiate with Contractors

Gather multiple quotes — never accept the first bid.

Avoid revealing your total budget upfront.

Structure payments in draws based on milestones — not one big upfront payment.

5. Don’t Skip Permits

Skipping permits to save time can backfire — buyers may back out, cities may fine you, or worse, you could be forced to redo or tear out unpermitted work.

6. Plan for Surprises

Hidden plumbing leaks, old wiring, or pests can derail your budget. Always keep 10–15% of your renovation budget as a contingency fund.

During the Sale: How to Sell Your Flip for Top Dollar

1. Market the Property Strategically

A great flip deserves great marketing:

Use professional photography and staging.

Write a compelling listing description highlighting new upgrades.

Host open houses and share virtual tours.

Promote on social media and through your agent’s network.

2. The Power of Home Staging

Staged homes sell faster and for more money because buyers can picture themselves living there. It’s worth the extra expense, especially in a competitive market.

3. Pick the Right Real Estate Agent

Look for an agent with proven experience in your area.

Ask for examples of past flips they’ve sold.

Make sure they have a clear marketing plan.

4. Price It Right

Research comparable sales and current market trends.

Don’t overprice — sitting too long on the market increases your holding costs.

Price competitively to attract multiple offers.

5. Understand Closing Costs

Typical selling costs include:

Real estate agent commissions (5–6% of the sale price)

Title insurance and closing fees

Transfer taxes

Final staging and marketing costs

Factor these into your profit projections from the start.

6. Minimize Holding Costs

The longer you hold a property, the less you make. Complete renovations on schedule and price the home to sell quickly.

7. Know the Tax Implications

Flipping profits are usually taxed as ordinary income, not long-term capital gains — especially if you own the property for less than a year. Consult a tax advisor to understand how your flip income impacts your tax bracket and what deductions you can claim.

Final Thoughts: Flipping Houses the Smart Way

House flipping isn’t a guaranteed fast buck — but with smart buying, strategic renovations, and a savvy sales plan, it can be a highly profitable way to grow your real estate portfolio.

✅ Do your research

✅ Stick to your numbers

✅ Work with trusted pros

✅ Plan for surprises

✅ Sell smart

Stay realistic, stay disciplined, and flip your way to your next big success.

Ready to start flipping houses? Research local markets, build your team, and remember: the profit is made when you buy and when you sell — but only if you renovate wisely in between.

If you found this guide helpful, share it or bookmark it for your next flip! Want more tips? Drop your questions below — let’s flip smarter together.

Comments